Canada currently has no active phosphate mines or processing facilities for the purified phosphoric acid (PPA) which is critical for producing lithium iron phosphate (LFP) batteries for electric vehicles and battery storage. LFP is a crucial technology for a low carbon economy.

LFP batteries are one of the battery technologies favored by many mainstream electric vehicle (EV) manufacturers including Tesla and BYD. The International Energy Agency states the market share for LFP batteries rose to 40% of EV sales and 80% of new battery storage in 2023.

Demand for LFP batteries is on the rise as automakers look for ways to further reduce the cost of EVs. Hyundai, Honda, and VW are all expected to begin using LFP batteries in some models in 2025.

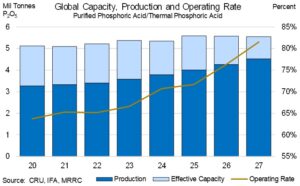

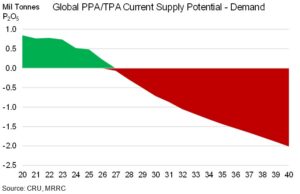

The automotive sector currently represents about 5% of PPA demand, but that number is expected to jump to 24% by 2030. This emerging demand will need to be satisfied by new supplies of phosphoric acid and PPA.

Furthermore, next-generation LFP and lithium manganese iron phosphate (LMFP) cathode chemistries are more energy dense, lower cost, and safer. Demand for these chemistries is expected to increase going forward.