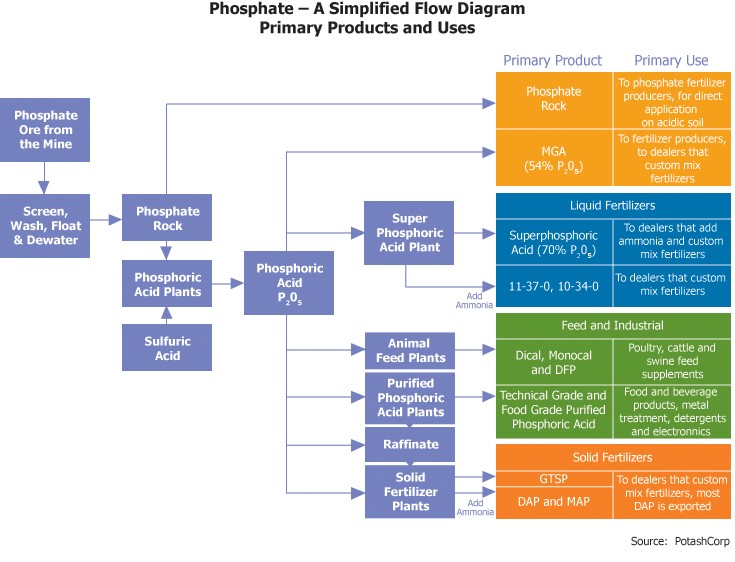

Phosphate is an essential fertilizer for the agri-food industry and is now crucial for growth in the Renewable Diesel (RD) and Sustainable Aviation Fuel (SAF) industries. RD and SAF rely on farmers growing more inputs such as canola and soybeans; these farmers will require more fertilizer to increase crop production.

RD is a perfect substitute for petroleum diesel and has none of the cold weather or other performance issues of biodiesel (a blend of petroleum diesel and non-hydrogenated biodiesel). RD is produced by hydrogenating vegetable oils (such as canola oil) or animal fats in a refinery that is similar to a petroleum refinery.

Demand growth for RD and SAF is being driven by state and national low carbon intensity fuel standards (LCIFS). So far, California (2010), Oregon (2015), Washington (2023) and Canada (2023) have passed legislation mandating LCIFS. More states, especially in the corn belt, are expected to follow.

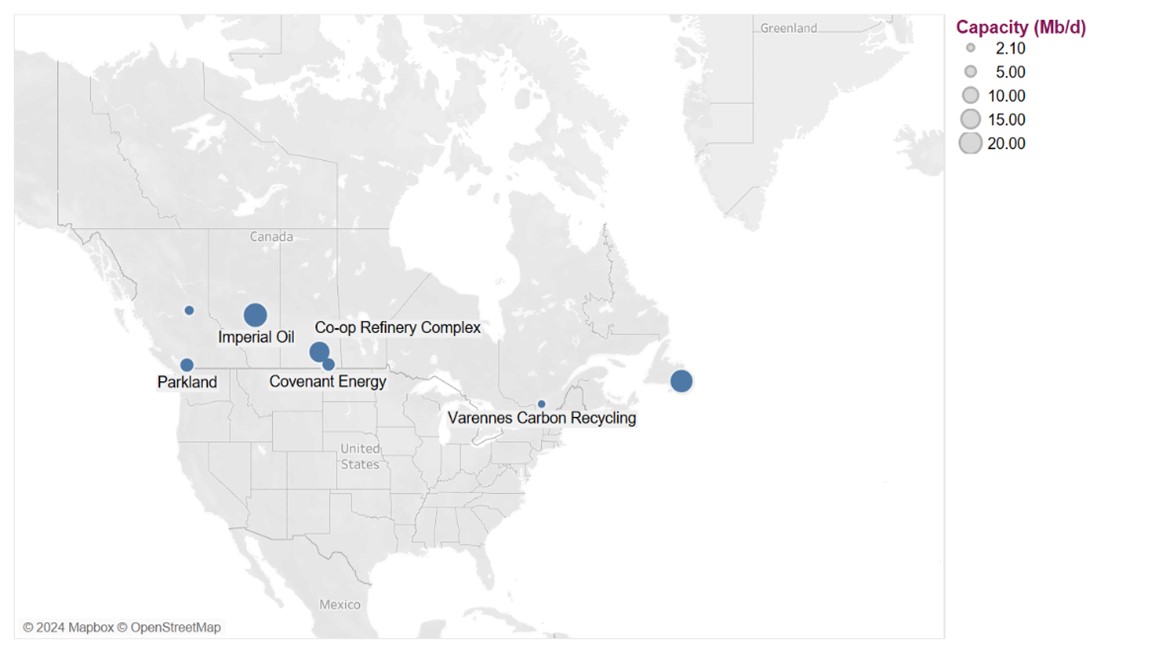

Driven by LCIFS, major Canadian and US airlines have committed to reducing their carbon footprints. United Airlines made its first flight using 100% SAF in December 2021. On December 10, 2024, Parkland Corp. announced it had successfully produced Canada’s first batch of low carbon aviation fuel at its Burnaby refinery and sold the fuel to Air Canada.

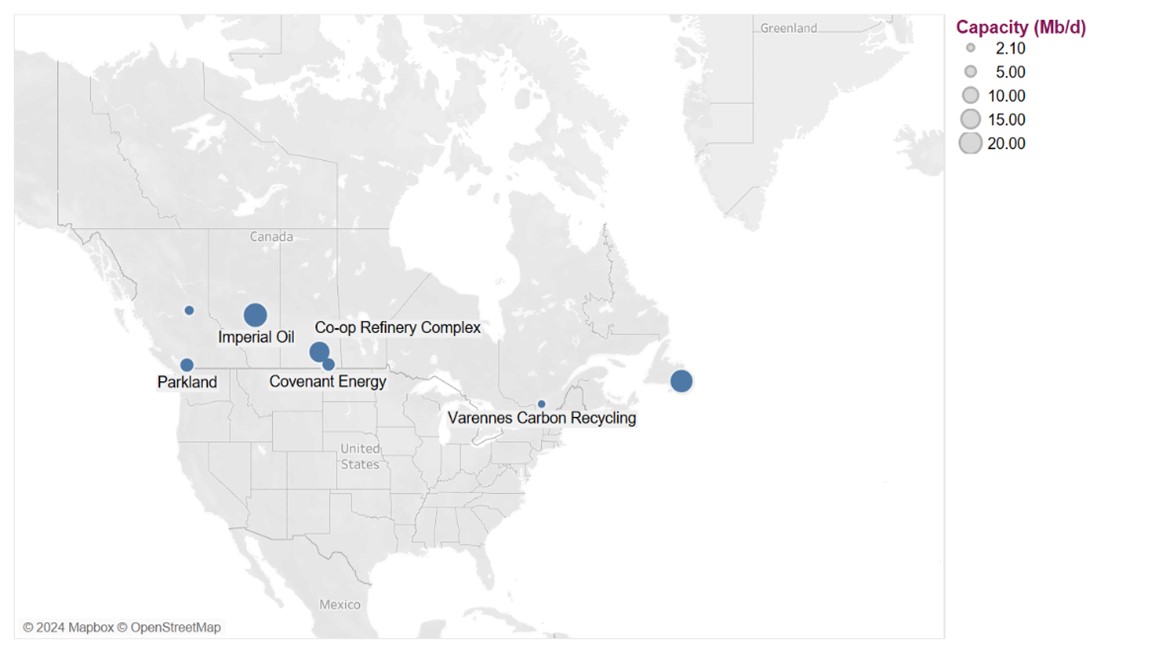

In Canada, there are seven new RD facilities planned, or under construction, in AB, BC, QC, and NFLD. These facilities would add up to 4.07 billion litres per year of production by 2027, up from zero in 2020.

Renewable Diesel Facilities in Canada

Imperial Oil’s 1.0 billion litre renewable diesel plant is scheduled to come online in the first half of 2025. This is to support Imperial’s partnership with Finning Canada to supply low carbon fuel to the Caterpillar mining fleets in Canada.

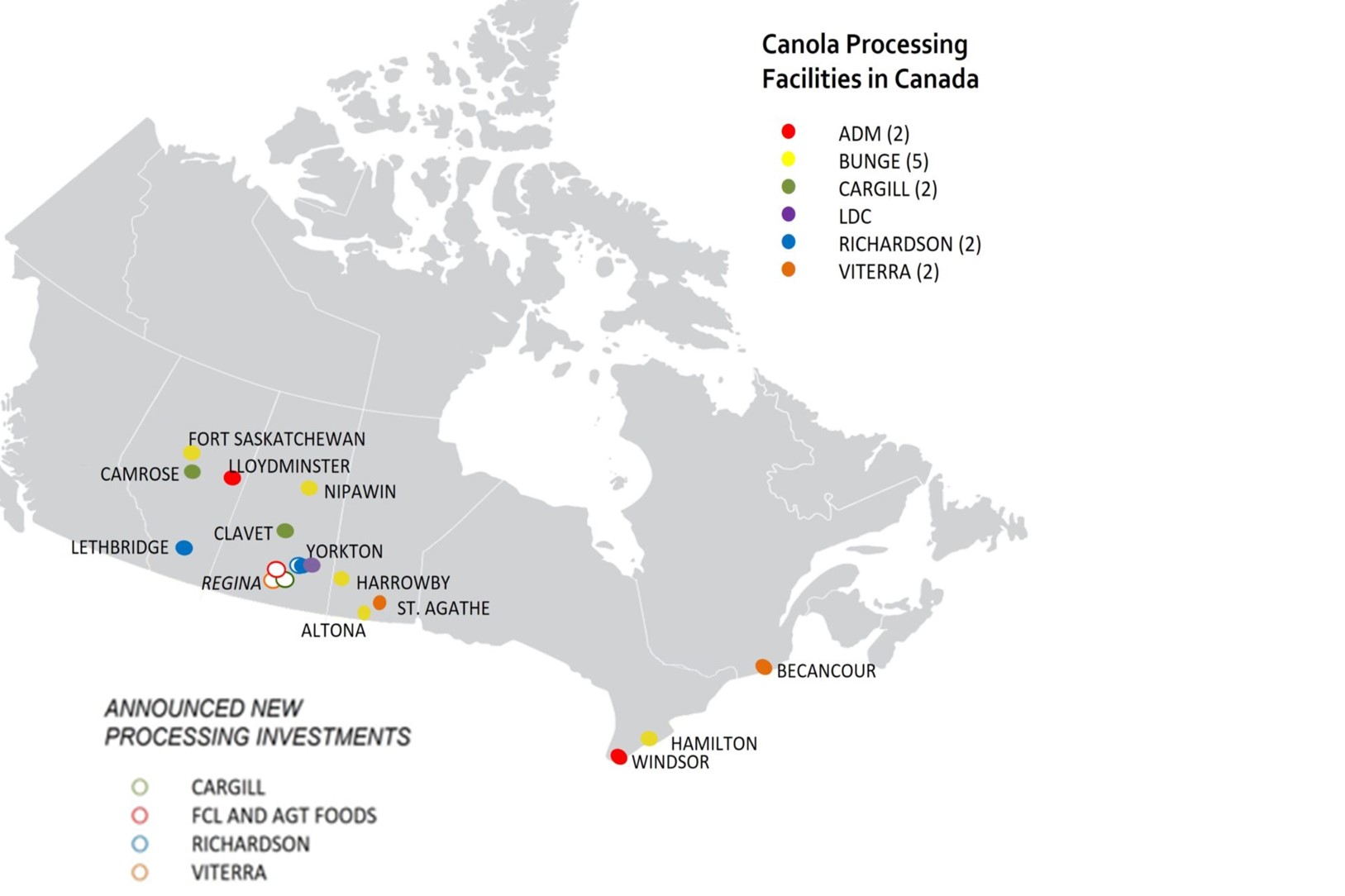

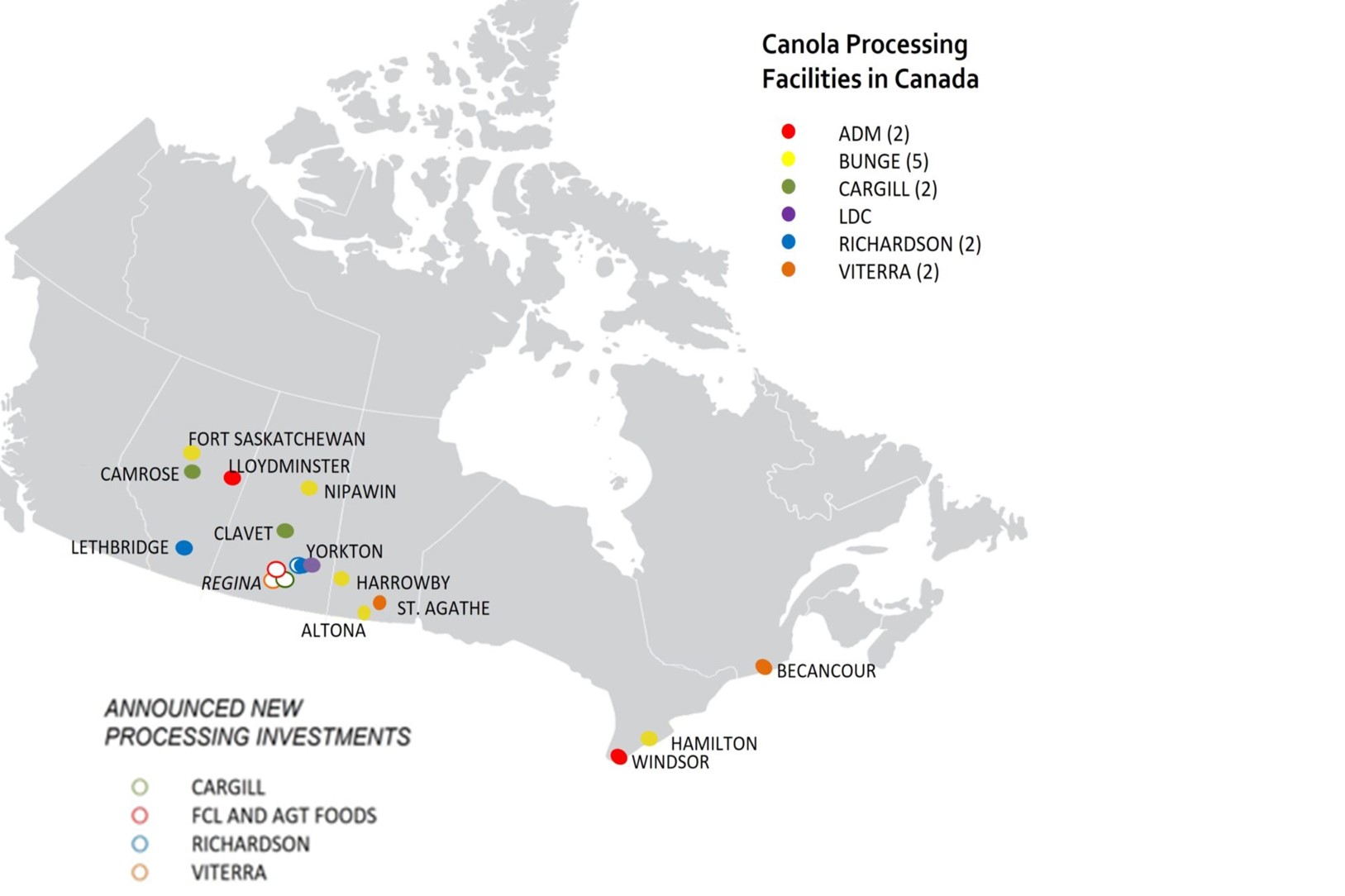

In Canada, canola production is projected to increase from roughly 20 million tonnes today to 30 million tonnes by 2030 to supply Canada’s expanding oilseed crushing capacity.

There are 14 canola crush plants with ~11.0 million tonnes of annual capacity operating in Canada today. Four major expansions adding nearly 6.0 million tonnes of annual capacity are expected online by 2026.

Canola Processing Facilities in Canada

North America’s growing production of RD and SAF is set to consume an estimated 2 billion tons of soybeans per annum, roughly 40% of all US soybean production by the end of this decade.

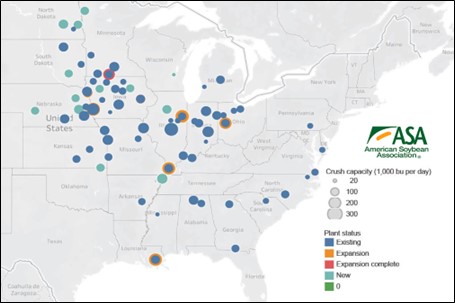

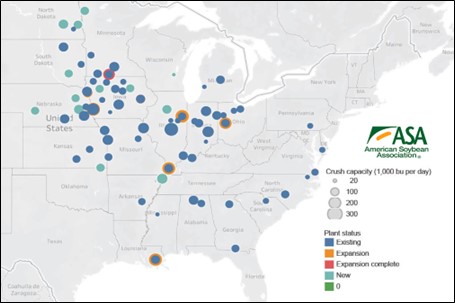

The American Soybean Association (ASA) has tracked 23 announcements of new projects. Of the total, 13 are greenfield projects and 10 are brownfield expansions. The projects are expected to add 750 million bushels of annual crush capacity during the next several years.

Soybean Crushing Facilities in US

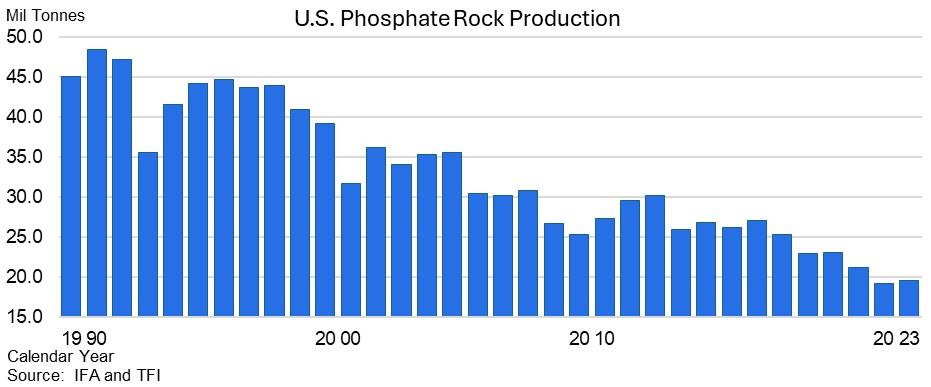

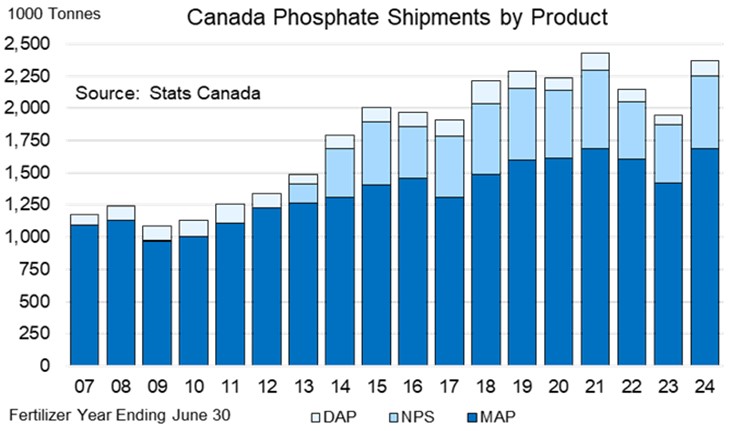

For farmers to continue feeding a growing world population and meet the increasing oilseed production needed to develop the RD and SAF industries, a secure domestic supply of phosphate fertilizer will be needed. Failing this, Canada runs the risk of becoming susceptible to higher import prices and the geopolitical risks associated with non-allied imports.